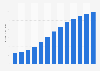

Nov 14, 2019 (The Expresswire) - Online Gambling Market Status and Trend Report 2019-2024 offers a comprehensive analysis on Online Gambling industry, standing on the readers' perspective.

- And now, with new research published this week by Juniper Research, online gambling could be set to get all the bigger in 2018. According to their findings, 2018 will see the value of online betting rise to over $700 billion, rising from $620 billion over last year.

- At that pace, the online gambling and betting market is expected to hit a value of USD $128.2 billion.

The amount of money bet online is expected to approach $1 trillion by 2021, according to a study by Juniper Research.

The $1 trillion isn’t revenue for online gambling platforms. Morgan Stanley estimated that the amount of online gambling revenue in 2014 was $37 billion, so online casinos win a small percentage of all the bets placed.

According to Juniper, the value of wagers this year will be $550 billion, so the market will nearly double over the next six years. The group also said that online bets would approach the entire spend on all digital goods and services.

The “majority of net growth” is attributable to mobile, the group said.

There’s been a “general trend” towards online gaming regulation, Juniper said. However, there are countries that have actually “hardened their stance in recent months and have moved towards outright prohibition.” Roughly three dozen countries ban online casinos.

Europe is where many of the roughly 85 nations across the world that allow online gambling are located. Europe is also where roughly 40 percent of worldwide online gaming revenue is generated. There’s still a lot of room for growth given the fact that about 56 percent of the world’s population is banned from accessing online casinos in their own countries.

Another key Juniper finding was that while Bitcoin has made been adopted by some top online gambling firms, it will likely not become commonplace in the industry.

The U.S. state of New Jersey, which was more than 90 percent of the regulated online gambling market in America, saw $3 billion in online bets in 2015. Only around 12 million Americans live in states with legalized online casino gambling.

Despite the growth of online betting, there’s been serious consolidation in the industry over the past two years. Regulatory costs have gone up, providing incentive for some firms to merge.

“The research argued that within an increasingly consolidated and maturing sector, providers had intensified their focus on securing customer loyalty,” Juniper said. “It observed that leading players were exploring a range of options to achieve this.”

“User engagement goes a long way towards drawing in return business,” research author Lauren Foye said in a press release. “Providing features such as news and media on favorite [sports] teams, as well as personalised offerings based on past betting activity, enables greater engagement and is likely to reduce churn.”

LONDON--(BUSINESS WIRE)--Technavio’s latest report on the global online gambling market provides an analysis on the most important trends expected to impact the market outlook from 2016-2020. Technavio defines an emerging trend as a factor that has the potential to significantly impact the market and contribute to its growth or decline.

Ujjwal Doshi, a lead analyst from Technavio, specializing in research on media and entertainment services, says, “In 2015, the global online gambling market is expected to grow at a CAGR of over 9% during the forecast period, as more than 85 countries worldwide have legalized online gambling. Online betting and online casino, together, accounted for 70% of the revenue generated from the online gambling market. Online gambling is a huge success among the public because of the wide range of games it offers and the convenience of playing without any location-constraints. China, the UK, Australia, the US, France, Germany, and Italy are some of the key revenue generating countries in the market.”

The global online gambling market is expected to exceed USD 60 billion by 2020.

Request a sample report:http://www.technavio.com/request-a-sample?report=52146

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

The top five emerging trends driving the global online gambling market according to Technavio media and entertainment research analysts are:

- Growing number of online women gamblers

- Increasing penetration of credit and debit cards

- Changing consumer gambling habits

- Use of alternative options to cash

- Changing marketing strategies

Growing number of online women gamblers

In 2015, the female gambling population contributed significantly to the overall online gambling market. The female gamblers accounted for 40% in the US and 49% in the UK in 2015. Studies show that women prefer to gamble in private, on their personal electronic devices so that they can play confidently and are less intimidated by male players.

In 2015, women under 35 years were far more active in online gambling than those above 35 years. Several online casinos encourage women gamblers, for example, Cameo Casino was the first online casino launched for women in 2015 with the slogan 'made by women, for women.' The casino was not a success and closed after two years. However, the market has matured and the trend is likely to pick up during the forecast period and encourage more women to engage in online gambling. Few other women centric online casinos are Pink Casino, Maria Casino, and 888Ladies.

Increasing penetration of credit and debit cards

The biggest challenge of online gambling market is the legal issues with different countries. Though several countries permit land-based casinos because it promotes tourism, they are extremely strict on online gambling. Some of these countries include South Korea, Japan, Portugal, and Norway. However, online gambling cannot be fully banned as users can access foreign websites with a proxy server and gamble easily with international credit or debit cards.

Governments do not take measures to ban these websites permanently because they assume that a person who engages in such activities are educated enough to know the consequences or financially well off to be affected by gambling losses. Another reason is that it will stop advertisers on the websites, resulting in loss of revenue.

Changing consumer gambling habits

Gambling Industry Trends

There has been a significant change in consumer behavior in the global online gambling market. The increase in the popularity of gambling apps and social gambling are the major factors that are expected to propel market growth during the forecast period. Vendors are leveraging the growth in internet using population and increasing adoption of mobile devices to develop innovative social gambling games. The number of people participating in social gambling are increasing as they are motivated to 'compete with friends.' Other reasons for the rise in the number of social gamers are 'socializing and interacting through games', 'user-friendly gameplay', and 'game tournaments'.

In addition, the increasing adoption of F2P (Free-to-play) model of social gaming across the globe will also drive market growth during the forecast period. This model does not generate revenue directly as it does not charge a participation fee. Instead, it charges for the virtual goods that players purchase to access the advance features of a game or to gain an edge over the competitors.

Use of alternative options to cash

Online gambling enables players to use virtual money which reduces the burden and risk of carrying cash as in the case of conventional gambling activities. Payment options through real cash online and virtual currency transactions through digital payment portals already exist in the market. The prize money is distributed as in-game virtual currency, which can be used to play other games or redeemed for cash. It also helps the vendors in tracking the spending history of the customers. “Another advantage of online gambling is the scalability, i.e., it can be used to reach a large gambling population, allowing vendors to make customized plans to target the customers,” says Ujjwal.

Changing marketing strategies

Direct mail is the most common marketing technique used for attracting potential gamblers. Also the vendors are using mobile apps to tap the mobile and online market.

The challenge for the vendors is to reach their customers through mobile devices and social media in a personalized and non-intrusive way. A high proportion of mobile users are millennials who skip through advertising. Thus, marketers will need to create content that is informative and entertaining, so as to attract new customers during the forecast period.

Browse Related Reports:

Do you need a report on a market in a specific geographical cluster or country but can’t find what you’re looking for? Don’t worry, Technavio also takes client requests. Please contact enquiry@technavio.com with your requirements and our analysts will be happy to create a customized report just for you.

Best Online Gambling Sites

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

Online Sports Gambling

If you are interested in more information, please contact our media team at media@technavio.com.